iowa capital gains tax exclusion

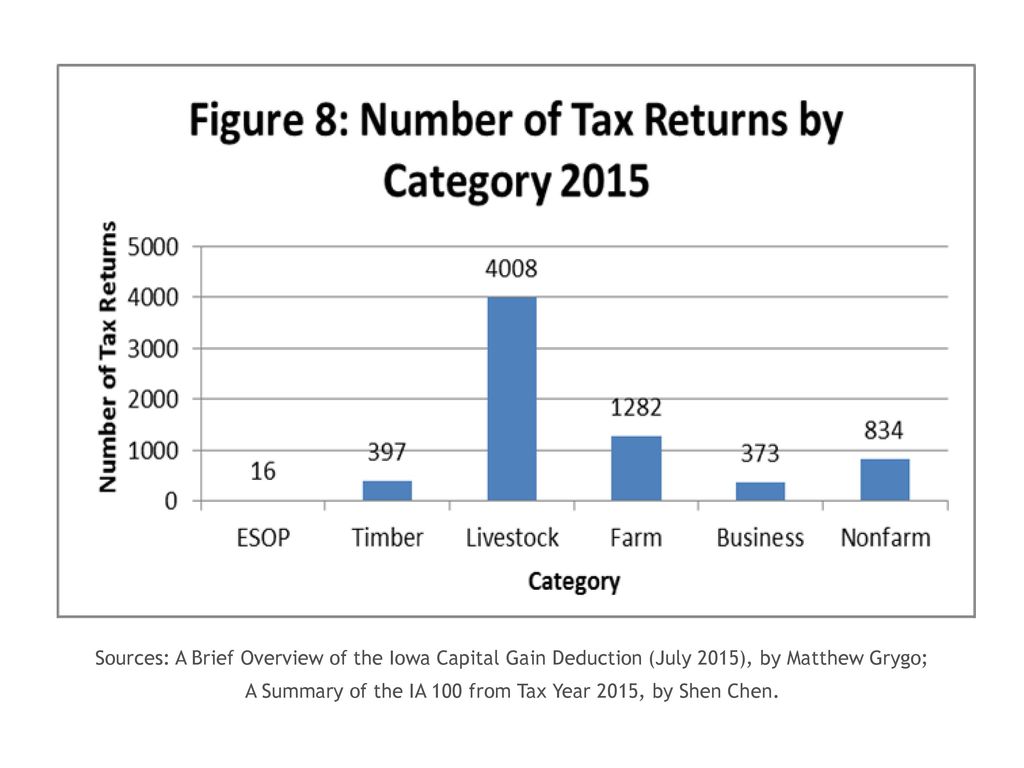

The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction.

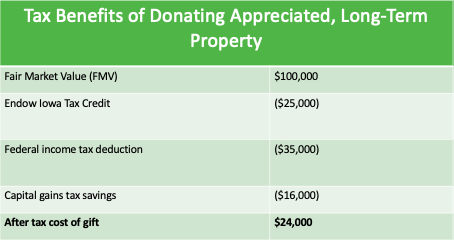

Final Four 4 Amazing Tax Breaks For Iowans On Charitable Gifts

4 rows You can sell your primary residence exempt of capital gains taxes on the first 250000 if you.

. Gains from the sale of stocks or bonds do not qualify for the deduction with the following exception. Iowans who are awarded capital stock from their employers currently pay all or some of the net capital gains taxes on those shares when they choose to sell them. The new law modifies Iowa Code 4227 to exclude from taxation capital gain arising from the.

Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. For the sale of business property to be eligible the taxpayer. Installments received in the tax year from installment sales of businesses are eligible for the exclusion of capital gains from net income if all relevant criteria were met at.

You cant claim the capital gains exclusion unless youre over the age of 55. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Certain sales of businesses or business real estate are excluded.

Iowa has a unique state tax break for a limited set of capital gains. The deduction must be reported on one of six forms by completing the applicable Capital Gain. The Iowa capital gain deduction allows taxpayers to exclude from income net capital gains realized from the sale of all or substantially all of the tangible personal property or.

Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income. The document has moved here. Allow one lifetime election.

Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. If a farmer chooses to sell off their property and livestock rather than rent it out the individual would be. Installments received in the tax year from installment sales of businesses are eligible for the exclusion of capital gains from net income if all relevant criteria were met.

If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction. Division I Sale of Certain Qualified Stock Net Capital Gain Exclusion. Introduction to Capital Gain Flowcharts.

At what age are you exempt from capital gains tax. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if. Iowa Capital Gains Deduction.

Effective with tax year 2012 50 of the gain from the saleexchange of employer. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161. The Iowa capital gain deduction is subject to review by the Iowa Department of.

It used to be the rule that only taxpayers age. How does the capital gains exemption work for retired farmers. Capital gains that qualify for the deduction result from the sale of real estate that is used in a trade or business in which the taxpayer.

A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if. By Joe Kristan CPA. June 23 2020 Blog.

When a landowner dies the basis is automatically reset to the current fair.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Rules For Military Families Military Benefits

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Iowa S Flat Tax Is Now Law When Tax Cuts Start And Other Key Changes

Form Ia 1040 Capgainwkst Fillable Capital Gain Deduction Worksheet 41 160

Iowa Supreme Court Affirms That Typical Cash Rent Landlords Not Eligible For Capital Gain Deduction Center For Agricultural Law And Taxation

Biden S Capital Gains Tax Plan Would Upend Estate Planning By The Wealthy Midwest Financial Advisors Group

Cutting Taxes For All Iowans Office Of The Governor Of Iowa

New Capital Gains Tax By Property Type

Capital Gains Tax Calculator Estimate What You Ll Owe

State Taxes On Capital Gains Center On Budget And Policy Priorities

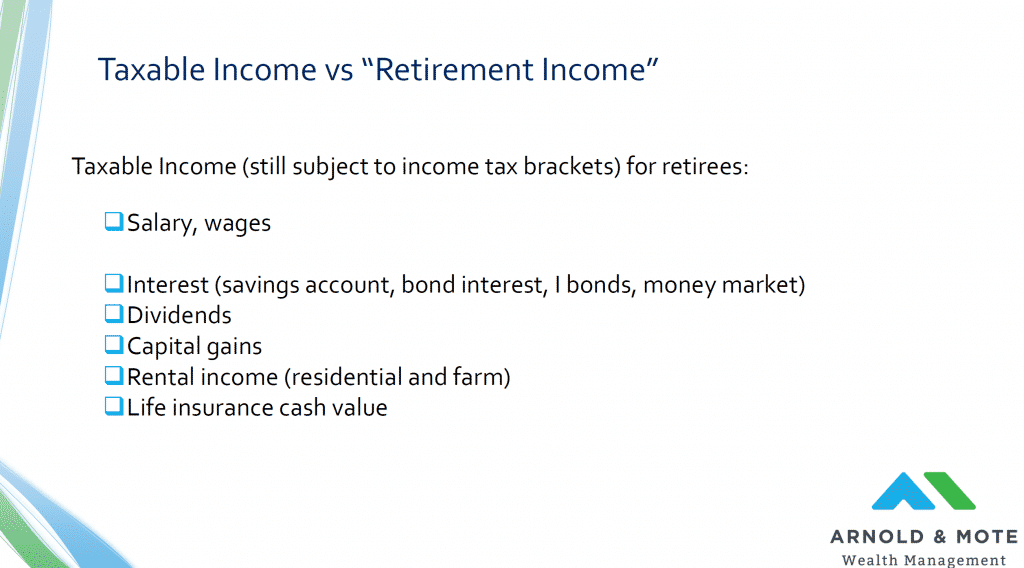

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

2022 Should Be A Gold Standard Year For Iowa Taxpayers The Gazette

State Taxes On Capital Gains Center On Budget And Policy Priorities

Do I Have To Pay Capital Gains Taxes If I Sold My Home

Iowa Capital Gain Deduction Ia 100 Form Series Ppt Download

![]()

Understanding Your Stock S Cost Basis The Planning Center

Will You Have To Pay Capital Gains Taxes On The Sale Of Your Home Charles Schwab